when is capital gains tax increasing

Above that income level the rate jumps to 20 percent. Discover Helpful Information and Resources on Taxes From AARP.

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

Among the many components of the Biden tax plan are an.

. If you sell small-business stocks or. Long-Term Capital Gains Taxes. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019.

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. Understanding Capital Gains and the Biden Tax Plan.

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase would lower federal revenue by 33 billion.

To increase their effective tax rate. The capital gains tax on most net gains is no more than 15 for most people. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in.

The proposal would increase the maximum stated capital gain rate from 20 to 25. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in 2022. Its estimated that the tax will bring in over 400 million in its first year.

In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. The large tax liability owed at filing is mostly the result of a surge in capital gains and other income from financial assets in 2021. While it technically takes effect at the start of 2022 it wont officially be collected until 2023.

As a reminder taxes on capital gains taxes are the gains increase in income realized on the sale of a capital asset. The effective date for this increase would be September 13 2021. I know that is a mouthful so let me.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Ad Compare Your 2022 Tax Bracket vs. From 1954 to 1967 the maximum capital gains tax rate was 25.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. With average state taxes and a 38 federal surtax the. Households owed more than 500 billion in.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Capital gains tax rates on most assets held for a year or less correspond to. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Those tax rates for. A long-term gain faces a maximum tax rate of 20 238 if your income is high enough to trigger the 38 net investment income surtax. Your 2021 Tax Bracket to See Whats Been Adjusted.

For single tax filers you can benefit. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income.

But the capital gains tax rate. Youll owe either 0 15 or 20. In 1978 Congress eliminated.

The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Capital gains tax rates.

Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0.

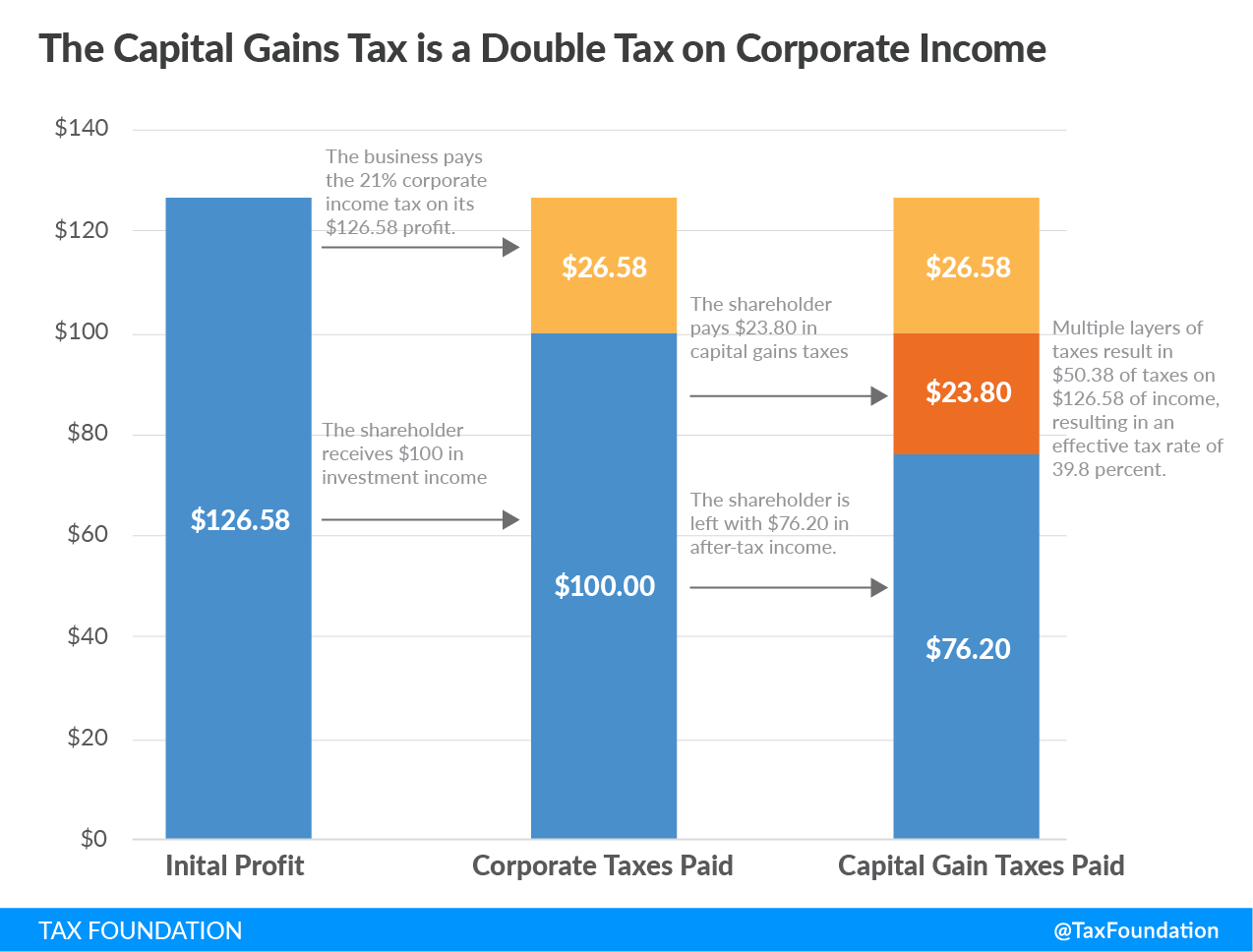

Double Taxation Definition Taxedu Tax Foundation

Capital Gains Tax What Is It When Do You Pay It

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

How To Avoid Paying Taxes On Inherited Property Smartasset

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

Selling Stock How Capital Gains Are Taxed The Motley Fool

Tax Advantages For Donor Advised Funds Nptrust

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Florida Real Estate Taxes What You Need To Know

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)