new mexico solar tax credit form

6 rows Yes the State of New Mexico has many solar incentives available to homeowners in 2022. The maximum New Mexico state solar tax credit is 6000 per taxpayer.

New Mexico Solar Incentives New Mexico Solar Company

SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the.

. Double-click a form to download it. Multiply line 5 by line 6. But the new solar tax credit really.

No Cost No Obligation. However this amount cannot exceed 6000 USD per taxpayer in a financial year. Form TRD-41406 New Solar Market Development Tax Credit Claim Form is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy Minerals.

We last updated New Mexico Form RPD-41334 from the Taxation and Revenue Department in March 2022. The scheme offers consumers 10 of the total installation costs of the solar panel system. It covers 10 of your.

New Mexico state solar tax credit. The process to claim the New Mexico solar tax credit is simple. Calculate Your Savings In 2 Minutes.

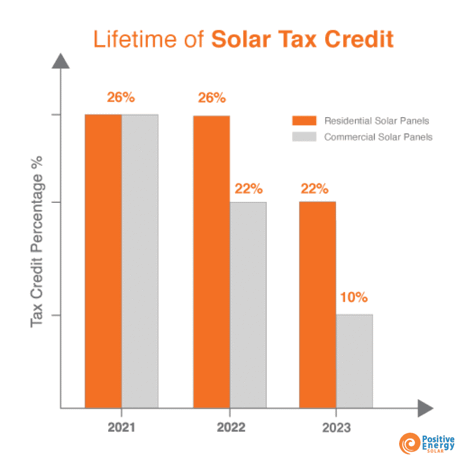

This incentive can reduce your state tax payments. The Residential Solar Investment Tax Credit ITC of the total cost of solar installation goes until 2019 at 30. The New Mexico solar tax credit is Senate Bill 29.

AVERAGE SAVINGS VALUE OF INVESTMENT TAX CREDIT. Enter Zip - Get Qualified Instantly. Enter Zip - Get Qualified Instantly.

Calculate Your Savings In 2 Minutes. Your solar specialist will calculate this for you and can consult with your accountant to fill out Form 5695 to claim your credit. Claiming the New Mexico Solar Tax Credit.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. Following the purchase of a solar installation the homeowner can file for a New Mexico state.

Each year after it will decrease at a rate of 10 per year. No Cost No Obligation. Tax Credit Forms Directions 1.

This is the amount of renewable energy production tax credit that may be claimed by the claimant for the current tax year. Expand the folders below or search to find what you are looking for. Ad Take Advantage Of Solar Tax Credit For 2022.

As of July 2016 there were 973 MW 2148000 MWh of projects in the waiting queue for the windbiomass tax credit and 1103 MW 2369000 MWh of projects in the waiting queue for. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The New Mexico Solar Income Tax Credit works very similarly to the federal ITC.

Your browser may ask you to allow pop-ups. Homeowners used to be able to carry forward any unused credit for up to five years but under. Form RPD-41334 is a New Mexico Other form.

In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. States often have dozens of even. Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill.

However it can take some time. State of New Mexico - Taxation and. 07152015 State of New Mexico - Taxation Revenue Department SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Schedule A.

Signature of taxpayer Date RPD-41317 Rev. The residential ITC drops to 22 in 2023 and ends. For information on Form TRD-41406 with the email address and phone number to the New Mexico Taxation and Revenue Department please go to the New Solar Market.

This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. Ad Take Advantage Of Solar Tax Credit For 2022.

New Mexico state tax credit. The process requires some. So the ITC will be 20 in.

Aleko 20w 20 Watt Polycrystalline Solar Panel Solar Panels Diy Solar Panel Solar

Tax Developments Impacting Climate Change In Ireland International Tax Review

Solar Plus Storage Vs Wind Plus Storage Pv Magazine International

Missouri Energy Tax Credit Missouri Missouri State Cape Girardeau

Power Trends Solar Leads Twitter Mentions In Q2 2021

Roadrunner Solar Project Texas United States Of America

5 Interesting Uses Of Wind Energy Wind Energy Solar Energy Diy Wind

New Mexico Solar Incentives New Mexico Solar Company

New Mexico Solar Incentives New Mexico Solar Company

Australian State Launches Solar Rebate Program For Estimated 1 Million Homes Pv Magazine International

The Federal Solar Tax Credit In 2022 Enphase

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

Aleko 20w 20 Watt Polycrystalline Solar Panel Solar Panels Diy Solar Panel Solar

6 Factors To Consider When Installing Solar Systems

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7YJJWO5PXFNXPMZUSRIMAZZEXA.jpg)

China To Stop Subsidies For New Solar Power Stations Onshore Wind Projects In 2021 Reuters

New Mexico Solar Incentives Rebates And Tax Credits

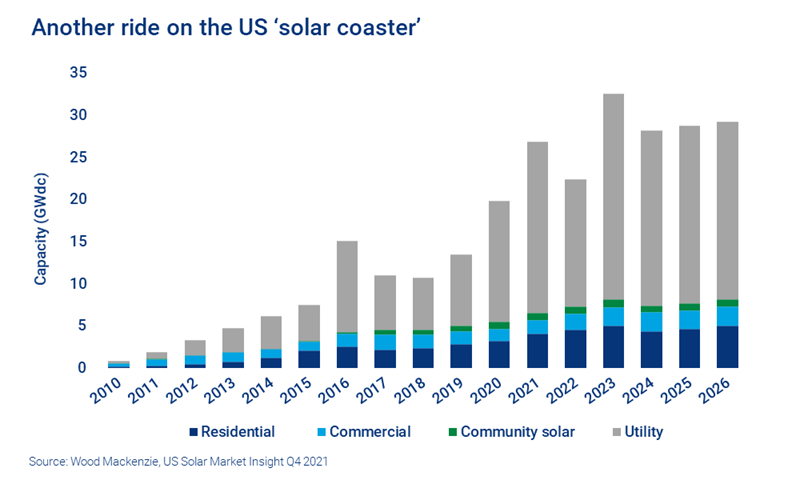

Redefining The Us Solar Coaster Wood Mackenzie

Solar Energy Advantages Of Solar Energy How Solar Energy Works Solar

Major Financiers Capitalise On A Growing Us Residential Solar Market Wood Mackenzie